Within the first days after arriving in Canada, you need to get six important documents. You won’t be able to live a full-on life in this country without them.

Within the first days after arriving in Canada, you need to get six important documents. You won’t be able to live a full-on life in this country without them.

Upon arrival in Canada, all foreigners undergo a landing procedure of checking their immigration status at the airport or another point of entry. The process of immigration does not end there — you will need to get all the necessary documents to live in the country.

1. PR Card

Permanent Resident Card (PR Card) is one of the most important immigrant IDs in Canada. You can get all other necessary documents only when you have your PR Card.

In most cases, an immigration officer at the airport initiates the issuance of a PR card on the day of your arrival. You need to indicate the address where it will arrive by mail within 45–60 days. If you still do not know where you will live, you can indicate your friends’ address or submit documents for the PR card later.

As a general rule, new residents are not required to apply for a PR-card, but they must report their Canadian postal address to Immigration, Refugees and Citizenship Canada (IRCC) within 180 days after arrival. IRCC will send a PR card to this address and you will not need to pay fees. If IRCC does not receive the address on time, you will need to apply for the card according to the general procedure and pay C$50.

To inform IRCC of your mailing address you need to use the online tool. To access it, you need to have the Confirmation of Permanent Residence number.

The PR card is issued for 5 years and can be renewed. This document confirms the status of a permanent resident and gives access to almost all social services that Canadian citizens receive, allows entering and leaving Canada unlimited times, gives the right to work and study in the country, as well as the right to apply for Canadian citizenship in the future. The only difference between the permanent resident and citizen statuses is that a permanent resident does not have the right to vote and participate in the political life of the country.

2. SIN

To get a credit card, bank loan, driver’s license, rent a home for a long term, apply for child benefits, health insurance, and documents for a job, you need to get a 9-digit Social Insurance Number (SIN).

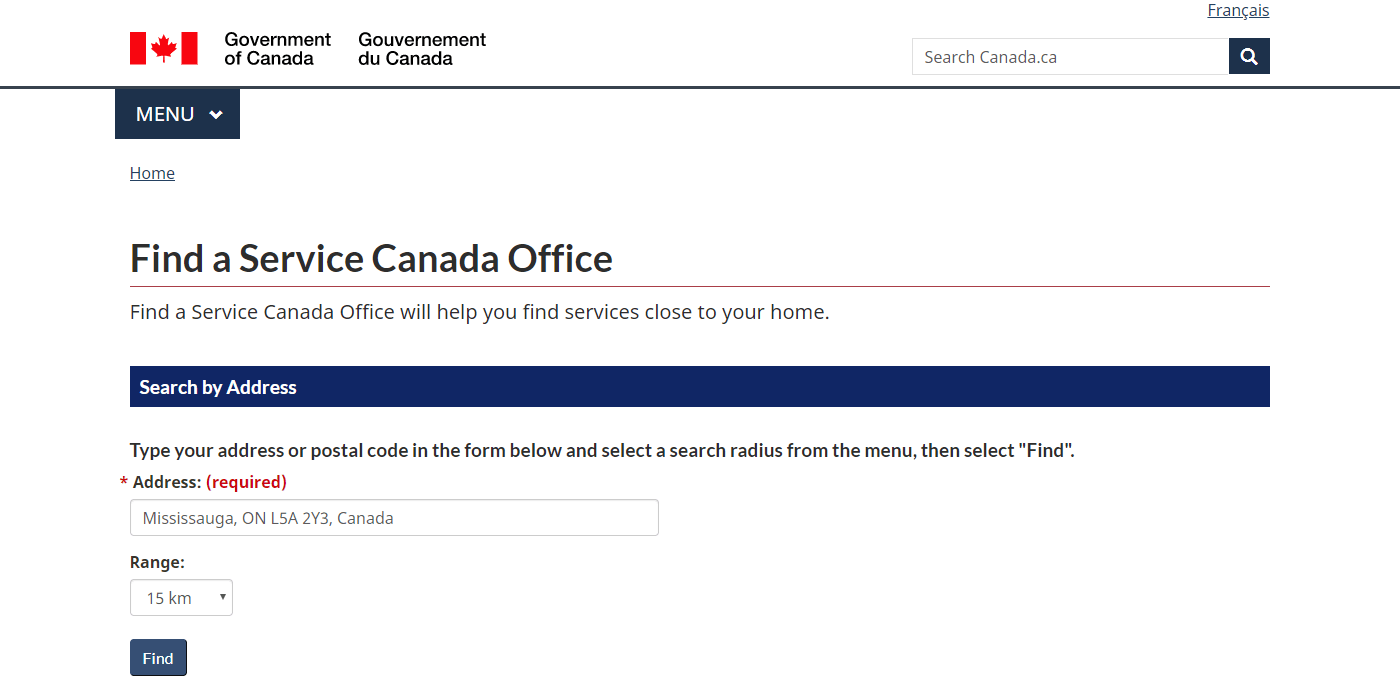

Sometimes a social security number can be issued right at the airport upon arrival, but this is not always possible. Typically, a SIN can be obtained at one of the offices of Service Canada, which are located in almost every community in Canada. To find the nearest point, use the online tool. Enter your address or postal code, search radius (in km) and click Find.

To get a SIN, all family members who have immigrated to Canada must come to Service Canada. Children 12 years and older may have their own social security numbers.

To obtain a SIN, you need to provide one of the documents:

- PR Card

- Confirmation of Permanent Residence with your passport

- Record of Landing or Verification of Landing

You will also need to indicate the mailing address to which the documents will be sent. If you do not have a permanent address, you can indicate your friends’ address.

If you live farther than 100 km from the nearest Service Canada office, you can apply by mail. You need to attach the original documents and the completed NAS 2120 form, and send your application to this address:

Service Canada

Social Insurance Registration Office

PO Box 7000

Bathurst, New Brunswick E2A 4T1

Canada

You can get the confirmation of SIN letter during a visit to Service Canada or — if you have sent your application by mail — at a post office within 20 business days. Processing fees are not charged.

You should not show your SIN to anybody. Give it only when applying for social benefits, scholarships, loans, and important documents.

3. Service Provider Agreement and SIM Card

It is recommended to buy a Canadian mobile operator’s SIM card as soon as possible, set up the mobile Internet and download the Google Maps application. This way, you will quickly find all the institutions and not get lost in the new city.

Canada’s largest mobile operators include Telus, Bell, Rogers, and Freedom. The planhub.ca and comparecellular.ca websites will help you choose the operator and data plan.

Mobile service in Canada is expensive. Standard plans require to pay even for those services that are usually provided in other countries for free, for example, incoming calls, calls between users of the same network, caller ID, etc. Unlimited packages cost C$75–100 per month.

Be careful when choosing not only a tariff plan but also a payment method. This may be an advance payment: first, you deposit money into the account and then use the service. In this case, you can refuse it at any time. But with the contract, everything is more complicated. On the one hand, conditions may be more beneficial. On the other hand, you will not be able to cancel the contract ahead of time: you will have to meet all the payment conditions until the contract expires.

In Canada, the phone number is tied to the user, not to the mobile operator. This means that if you change the operator, you can keep the number.

4. Credit Card

It is important to get a credit card within the first days after arriving in Canada because it will allow you to build a credit history that is useful for renting a home for a long term and getting a bank loan.

A credit history in Canada starts from the moment of opening a bank account and getting a credit card and takes about 3 months of actively using a credit card.

With a credit card, you can borrow a limited amount of money to pay for goods and services. Some banks charge an annual fee for certain cards. Interest rates on the purchase of goods can start at 9% and exceed 20%. To choose a credit card, you can use the Credit Card Comparison Tool.

Without a credit history, you can get a card with a credit limit of C$1,500 to C$2,000. This means that even if you do not have anything in your bank account, you can buy goods in the amount of the limit. You need to refill the account within a month. If you fail to do it, the credit history will start to deteriorate and the credit rating will drop. You will also be charged a fine of about 20% per annum of the amount owed.

If upon requesting a credit card you are unable to convince the bank of your financial responsibility, you can open a secured credit card that is safe from risk. To do this, you need to deposit a sum of money into the account of the bank that issued the credit card. The credit limit is usually set as a percentage of your deposit. If you pay the amount to the card on time, you can start building your credit history. As soon as the bank considers your credit history satisfactory, you can open a regular credit card.

5. Medical Insurance

Healthcare services in Canada are free, as costs are included in taxes. But new immigrants in most provinces cannot use the state healthcare insurance immediately after arrival. If you have to see a doctor, you will have to pay at the same prices as foreigners (and your bills can amount to thousands of dollars).

In half of the Canadian provinces and territories, new immigrants get access to provincial health insurance on the day of arrival. However, in other regions, there is a waiting period of up to 3 months after applying for a residence permit. This rule applies in British Columbia, New Brunswick, the Northwest Territories, Ontario, Prince Edward Island, Quebec, and Saskatchewan.

For example, if you moved to New Brunswick on August 20, August will be considered the first month, and September and October will be the next two. In this case, you will get access to the state insurance on November 1.

If you do not want to pay thousands of dollars for medical services in Canada, get a Visitors to Canada Travel Medical Insurance or Insurance for Visitors to Canada.

The recommended coverage is C$50 thousand, the recommended insurance period is 3 months (or the remainder of the current month plus 2 months). Private health insurance costs between C$125 and C$500, depending on your age, insurance coverage, current illnesses, and the insurance company.

Popular insurance companies in Canada are 21st Century Enhanced, Destination Canada, Travelance, and Manulife. The latter is more expensive and recommended for those who have a heart condition.

6. Driver’s Licence

Citizens of the US and many EU countries can exchange their driver’s licences to the Canadian ones right after the arrival in the country.

The others need to pass tests to get the Canadian driver’s licence. However, you can use a driver’s licence issued in your home country in Canada for a short time after the arrival: 6 months in Quebec, 90 days in Alberta, British Columbia, Manitoba, and Saskatchewan, and 60 days in Ontario.

After arriving in Canada, you need to apply for a driver’s licence in the province or territory where you intend to live in order to legally drive a car there. The Canadian driver’s licence is a plastic card with your photo, name and surname, your address, and signature.

The process for obtaining a driver’s licence in Canada depends on the province or territory where you live. It normally includes:

- Written test on Canadian traffic regulations (you can download or buy a study guide, or take tests online on a site developed by driving instructors)

- One or two road tests (practical tests)

A few tips on how to pass the road test:

- Before arriving in Canada, take a certificate of driving experience in the police department or another body that issued your driver’s licence in your home country. It must be in English or French. Getting this certificate may be difficult, but if you succeed, it will facilitate the process of exchanging your driver’s licence to the Canadian one.

- When you are already in Canada, study traffic rules in English to pass the written test and pass the theory in English. This will help in the road test when the instructor will make comments and ask questions.

- Take a few driving lessons in Canada. You can even find instructors who speak your native language, as there are many driving schools in Canada.

- Traffic regulations in Canada may differ from those in your country. Don’t forget about the shoulder check during the road test. If you do not do this, you can fail the test.