A tax return is a report for a tax authority about the money you earned and taxes you paid for the tax year. In Canada, this document is filed by both residents and non-residents who get income in the country.

A tax return is a report for a tax authority about the money you earned and taxes you paid for the tax year. In Canada, this document is filed by both residents and non-residents who get income in the country.

Canada’s tax system is based on the self-assessment principle. This means that people file a tax return every year to declare their annual income, claim deductions or benefits, and find out whether they owe tax or can hope to get a refund.

Who Must File a Return

Canadian residents have to file a tax return every year, even if they do not pay taxes. Each family member is required to file a separate return.

Non-residents must file tax returns if they earn income from employment or business in Canada, as well as from capital gains on the sale of Canadian real estate. Most likely, you have to file a tax return, even if you lived in this country only part of the year.

In general, you have to file a tax return if you:

- Have to pay tax for the year (income tax or capital gains tax on the sale of real estate)

- Want to claim a refund

- Received or want to claim a Working Income Tax Benefit (WITB), Canada Child Benefit (CCB), Goods and Services Tax (GST⁄HST) credit, or a Guaranteed Income Supplement (GIS)

- Received from the CRA a request to file a return

- Intend to split pension income with your spouse or common-law partner

- Have to repay all or part of your old age security or employment insurance benefits

- Have not repaid all the amounts you withdrew from your Registered Retirement Savings Plan (RRSP) under the Home Buyers’ Plan or the Lifelong Learning Plan

- Have to contribute to the Canada Pension Plan (CPP) — if your income exceeds C$3,500

- Are paying employment insurance premiums on self-employment income or other earnings

- Have incurred a non-capital loss in the year that you want to be able to apply in other years

- Want to transfer to a future year the unused part of your tuition fees

- Want to report income that would allow you to contribute to an RRSP, a Pooled Registered Pension Plan (PRPP), or a Specified Pension Plan (SPP) to keep your maximum deduction limit for future years

- Want to carry forward to a future year the unused investment tax credit on expenditures you incurred during the current year

You have to file a tax return in any case, regardless of whether you pay taxes on your own as a self-employed person or whether your tax is withheld by your employer.

When To File a Tax Return

Those who have previously filed tax returns in Canada, before filing a new return, first receive a notice of assessment, which the CRA starts sending out in February. This document contains contact information, notification information, key filing information, an account summary, and helpful tips.

The first day of filing tax returns online is February 18. And the deadline for filing both online and offline is April 30.

The deadline is extended until June 15 for self-employed persons (those who earn income on individual entrepreneurial activity). However, they still have to pay taxes by April 30. If June 15 falls on a weekend, the deadline is postponed to the next working day (for example, to June 17 in 2019).

Companies file tax returns within six months of the end of the tax year (the financial period for which accounting reports are prepared).

What To Include in the Tax Return

Each province and territory has its own tax return form. You can download the forms on the official website of the Government of Canada. Select the filing year and the province where you lived in the tax period. Tax return forms for Quebec can be found on the Revenu Québec (provincial tax office) website.

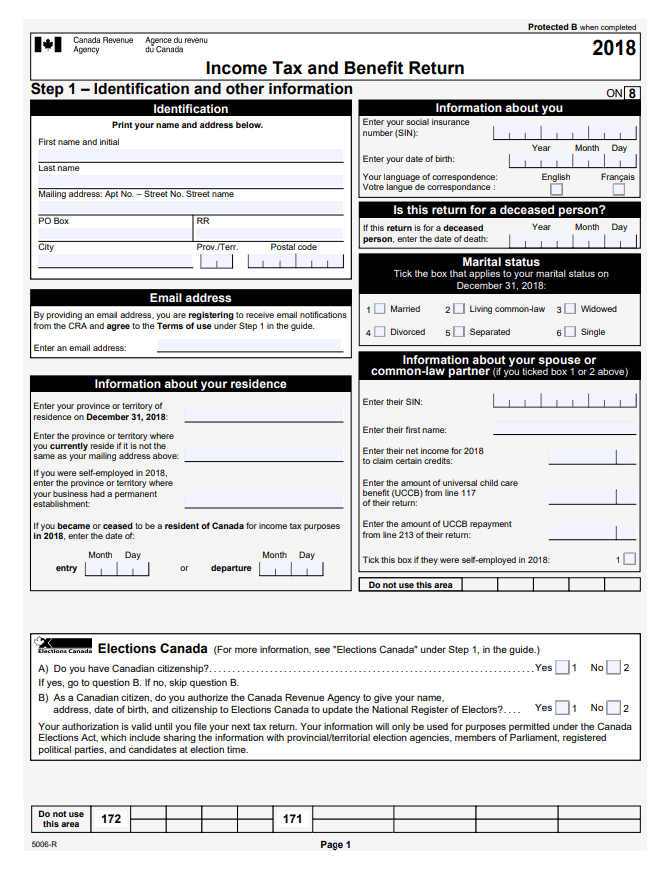

For instance, here is the first page of the tax return form in Ontario:

If you filed a tax return for the previous year in paper form, the tax office will send you a form by mail next year. You can also order delivery of the paper declaration form to your home address.

The main form of the tax return should include the following information:

- Personal information: first name, last name, home address, email address, date of birth, social security number (SIN), marital status

- Immigration status or citizenship

- Property outside of Canada

- Income and income sources (Canadian residents must include information on their income from sources in both Canada and abroad)

- Tax refunds and tax owed

There are also separate forms for calculating federal and provincial taxes, tuition fees, gift income, etc. The package depends on what taxes you pay and what deductions or benefits you expect.

How To File a Tax Return

If you are self-employed, to file a tax return in Canada, you will need a completed T4 form — the final payment form that you get from your employer. This is a summary of the previous tax year that shows the name of the employer, your income for the year, your personal information and SIN, contributions for employment insurance (EI) and withheld income tax.

Employers usually send this document to employees no later than February 28. If you have worked for several companies during the year, make sure you get T4 from each of them.

There are several ways to file a tax return:

- NETFILE is a service that allows you to file your tax return online electronically using software or a web application. A list of available programs and applications, including free ones, can be found on the NETFILE web page.

- Auto-fill my return is a CRA service that allows you or your authorized service provider to automatically fill out parts of a tax return based on tax invoices such as T4, as well as on the information about registered retirement savings plans. To use this service, you need to have a personal account on Canada.ca and use a certified software product that offers this option.

- By mail: the addresses of tax centres can be found on the official website. If you are a non-resident, this is the only way you can file a tax return.

In Quebec, you can also file a tax return online on the Revenuquebec.ca website.

Late-Filing and Failure To Report Penalties

If you submit your tax return late or if you fail to file it, you will have to pay a fine.

Tax Debt

If you owe tax, the CRA accrues a compound daily interest starting May 1 of the year following the tax year for any unpaid amounts due for that year. In addition, the CRA accrues interest on fines starting on the day following the filing date. The interest rate charged by the CRA is reviewed every three months.

Late Filing

The late-filing penalty is 5% of the amount owed plus 1% for each full month of late filing, up to a maximum of 12 months.

For instance, if you submit a tax return on July 20, 2019 (and you should have submitted it before April 30, 2019), you will be charged a penalty of 7% of the balance outstanding by April 30, 2019 (5% plus 2% for two full months of filing late).

Even if you cannot pay the full amount of the tax before April 30, you can avoid the late-filing penalty by submitting your return on time.

Failure To Report

In Quebec, there is a separate penalty for failing to file a tax return — C$25 per day (up to a maximum of C$2,500), to which a late-filing penalty is added.

Repeated Failure To Report

If you have not indicated an amount of income of C$500 or more for a tax year, this will be considered a failure to file a tax return. In this case, the penalty is 10% of the non-declared amount or 50% of the difference between the understated tax and the amount of tax withheld (whichever is less).

If you inform the CRA of an amount that you have not declared, the CRA may cancel this penalty.

False Tax Return and Omissions

You will have to pay a penalty if you have filed a declaration with false information, as well as if you made omissions by intention or negligence. In this case, the penalty is C$100 or 50% of the amount of tax omitted, whichever is greater.

However, if you inform the CRA about the amount that you did not declare or about tax benefits that you overestimated, the CRA may cancel this penalty.

Getting Help with Your Tax Return

You can file a tax return with the help of an accountant or tax agent, whose services cost about C$25, or you can buy a special program for C$15–20 and file a tax return yourself.

If you have a modest income (up to C$35 thousand per person without a family or up to C$47.5 thousand for a family of three people), a simple tax situation (for example, you get only employment income) and you need help filing a tax return, contact your nearest “tax clinic” or volunteer service to get help for free.